Regulatory changes mean companies producing or using construction materials and chemicals must reduce emissions, improve energy performance, and boost circularity. Sagentia Innovation’s Caitlin Howe and Dr Caroline Potter say opportunities exist across both incremental and disruptive innovation, but expert navigation of trade-offs is key.

With the construction industry under increasing pressure to reduce negative environmental impacts, the entire value chain is implicated. Production of core building materials including cement, steel, and polymers is particularly emissions-intensive, with cement and steel each accounting for 7% of global CO2 emissions. Recent and emerging regulatory developments will impact all chemicals companies and materials manufacturers that supply the construction industry.

Read on for analysis of key factors that will support innovation and market readiness as chemicals and materials companies respond to sustainability targets that are reshaping the construction landscape.

Scroll right down for a table summarising where gains are being made and where further innovation is needed.

Optimising sustainability in the construction sector

The scale of the opportunity for sustainable construction materials is significant, with market worth projected to reach $900 billion by 2034.

Many materials and chemicals companies are already developing advanced additives and formulations that support lower-impact construction. These include superplasticisers for low-carbon concrete, air-entraining agents for durability, and low-VOC coatings, sealants, and insulation materials that contribute to energy efficiency and indoor air quality.

Such developments are indicative of a shift in the innovation mindset: as well as developing new materials, manufacturers are rethinking existing materials to meet sustainability goals. Yet moving to more sustainable construction introduces new design constraints across carbon performance, circularity and compliance. These must be balanced against technical feasibility, cost and market readiness.

To navigate these complex matters, we advocate three core principles: making performance and commercial viability central to the innovation strategy, optimising existing portfolios and processes where possible, and planning for market entry from the outset.

1. Innovate for performance and commercial viability

Sustainable materials that demonstrate strong potential in research conditions can struggle when it comes to real-world integration, certification, and performance. Lower-carbon or recycled materials may not match the strength, durability, or processing characteristics of conventional materials. What’s more, the growing emphasis on low carbon and circularity means materials must meet new expectations surrounding how they are sourced, used and recycled.

These constraints often require trade-offs, not just between sustainability and performance, but between different aspects of sustainability. Take bio-based materials like hemp and cellulose. They can offer lower embodied carbon, but cultivation and processing may be water intensive. Likewise, composites designed to maximise thermal performance may hinder recyclability if it is difficult to separate the constituents.

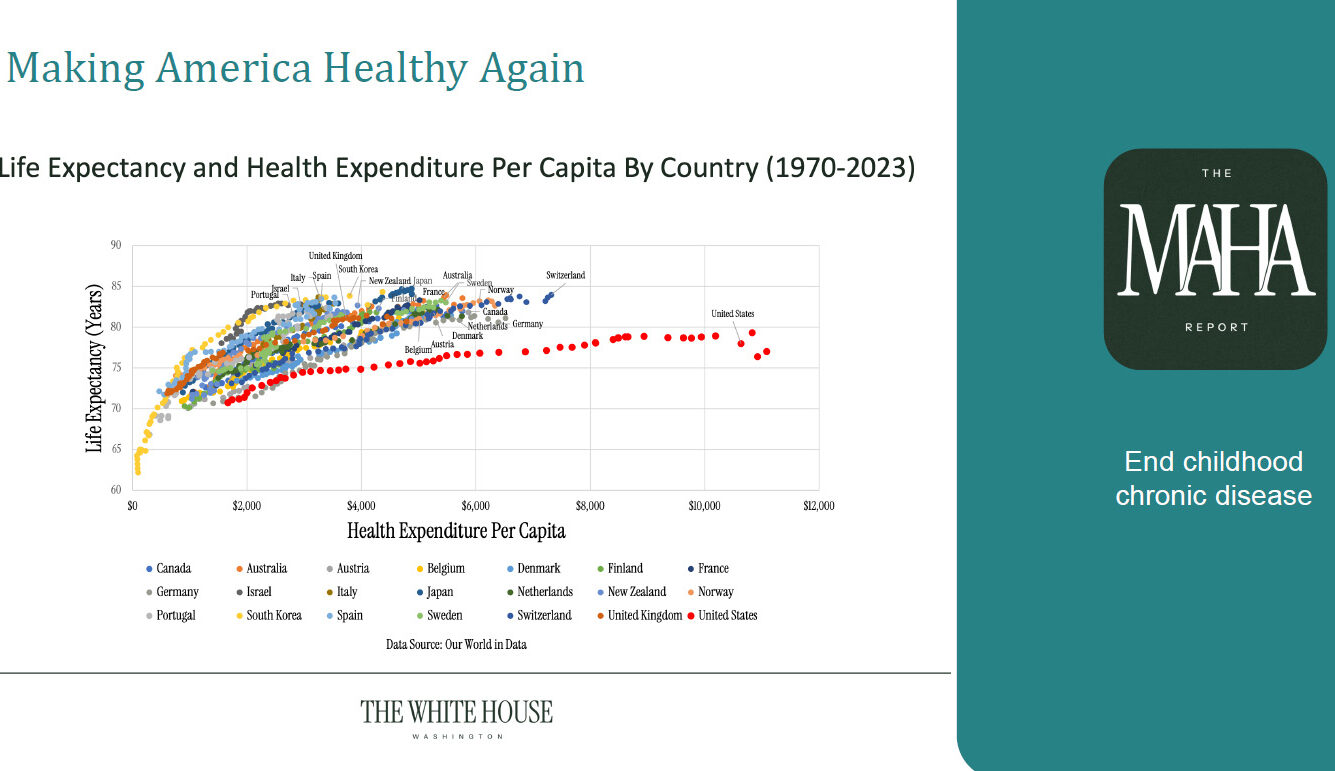

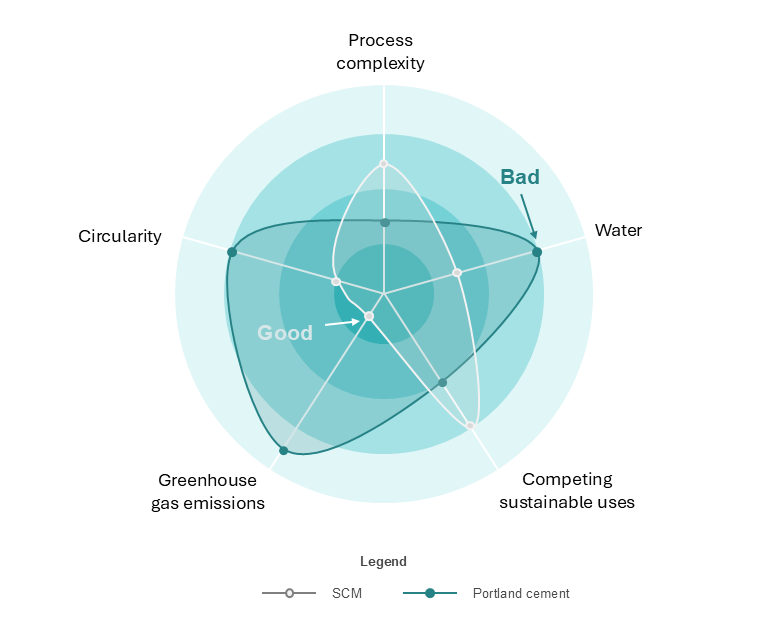

Figure 1: Several sustainability trade-offs must be considered when substituting cement with SCMs

The trade-off challenge is particularly apparent in the substitution of regular Portland cement with supplementary cementitious materials (SCMs). Advantages of SCMs include reduced carbon emissions, better circularity and lower water usage. However, these gains may be undermined by process complexity and competing sustainable uses of raw materials, especially as availability of fly ash and blast furnace slag decline. Figure 1 shows how these trade-offs can be systematically assessed then visualised to aid decision making. (The Sustainability Trade-off Tool in our CTO Forum Growth and Sustainability playbook outlines an effective way to work through this process).

Apply a multi-disciplinary approach

Even when materials meet technical and regulatory requirements, cost can remain a major barrier to adoption. Alternatives may require new processes, introduce uncertainty into established workflows, or simply use more expensive materials. It can be hard to quantify or monetise likely environmental benefits across the lifetime of complex projects, so it may be difficult to make a compelling case for investment.

For instance, in our work we have seen many recurring challenges around the enablement of circular solutions for construction materials. Defining the waste value chain, emergent recycling technologies and active players, then using this to work out a future viable business model is highly complex.

Such challenges are rarely solved in isolation. They require coordination across R&D, operations, and regulatory planning. Trade-offs must be evaluated and contextualised at the earliest opportunity. For example, higher upfront costs may be justified by downstream savings linked to improved durability, reduced maintenance, or compliance with emerging regulations.

It’s useful to understand where collaboration might be needed as sustainable change often requires joined-up, system-wide effort. Involving the right partners (e.g. policy makers, trade bodies, peer companies, and organisations outside your direct value chain) helps establish a shared vision focused on practical outcomes. Another dedicated tool in our CTO Forum Growth and Sustainability playbook considers how to initiate and implement system change, from initial partner engagement through to the scaling of tested solutions.

2. Optimise existing portfolios and processes

The rapid evolution of sustainability requirements can outpace the ability to develop and commercialise new materials. In this context, innovating around existing products and production systems is a pragmatic option.

A structured portfolio review can identify products for reformulation, repositioning, or requalifying in line with new environmental standards. This might involve reducing embodied carbon, substituting raw materials, or aligning with procurement frameworks that prioritise sustainability.

Leveraging opportunities like these typically requires the involvement of product development, operations, and compliance professionals. For instance, emissions sources may need to be mapped right across the value chain. Technical feasibility will need to be assessed. And changes will have to align with regulatory and market expectations. The aim is to identify achievable, impactful opportunities for innovation that will not disrupt core operations. Operational changes – such as optimising energy efficiency and switching to lower-carbon inputs – require a similar approach.

Think about the long-term

In some cases, advanced strategies such as carbon capture and utilisation (CCU) can support emissions reduction and materials innovation. The mineralisation of CO2 into construction materials is a case in point. It’s also important to consider energy use and maintenance over a building’s lifecycle. High performance insulation or more durable materials may perform better over longer timeframes, in terms of sustainability and costs.

There may also be opportunities to repurpose or recover waste. This could support circular economy goals and reduce raw material demand – a critical consideration in a sector that generates approximately 35% of total global waste. However, it’s important to note that circularity is about more than recovery. It demands a fundamental rethink of how materials are sourced, designed, used, and managed at end of life.

Long product lifespans mean construction materials created today may not become waste for 20+ years. Meanwhile, materials entering the waste stream today were designed decades ago, often without recovery in mind. A viable circular process must address both forward looking design and legacy waste. This requires new systems such as reverse logistics, material tracking and end of life recovery, which go beyond the traditional value chain.

Recovery strategies might include mechanical recycling, depolymerisation or reconditioning. Putting these systems into place typically involves collaboration with new partners across recycling and logistics. Advocacy is important here, and it may be necessary to work with competitors. It’s about developing a cohesive, evidence-based strategy to support change in conjunction with key stakeholders across the value chain. While this can be complex, it’s essential for building commercially viable and scalable circular systems.

3. Plan for market entry

Even when a material is technically and commercially ready, downstream barriers can hinder adoption. Regulatory matters, certification processes, integration issues, and lack of familiarity often introduce friction that delays uptake.

Consider regulations upfront

The surge in legislation and standards to accelerate sustainable practice across the construction sector raises many important considerations. Buildings and infrastructure must meet tougher environmental requirements, and the EU’s Construction Products Regulation (CPR) that lays down rules for the marketing of construction products was revised and expanded in January 2025 to directly address sustainability. For example, EU CPR now includes specific environmental requirements for construction products and promotes transparency through digital product passports. It also requires contractors to apply mandatory minimum environmental sustainability requirements for certain projects. Similar change is expected in the UK soon following a recent public consultation.

Alongside the EU ambition to achieve net greenhouse gas emissions reduction targets by 2030 (55% below 1990 levels) and 2050 (net zero), there is increasing focus on circularity to minimise waste and raw material use. Additional requirements impacting building materials companies, their formulators, and chemical suppliers include:

- Energy Performance of Buildings Directive (EPBD) – requires insulation, windows, doors, and other building materials to meet specific energy performance criteria to reduce heat loss and improve overall energy efficiency.

- Emissions Trading System – extended to cover and address CO2 emissions from fuel combustion in buildings.

- Carbon Border Adjustment Mechanism – covers ‘carbon costs’ of products manufactured outside the EU.

- Ecodesign for Sustainable Products Regulation (ESPR) – expected to set requirements for materials such as iron, steel and aluminium.

- A new Circular Economy Act, expected in 2026, will prioritise material longevity, recyclability, and reduced reliance on virgin materials in the construction sector, reducing the environmental footprint of buildings.

From a US perspective, while there has recently been a retreat from climate action at a federal level, state commitments and activity remain strong. Across the country, states are updating building codes and sustainability regulations to set the stage for a greener future. For example, California launched the first state-mandated green building standards code, CALGreen. As of July 2024, large non-residential buildings in the state are subject to mandatory embodied carbon reduction requirements, meaning their design must consider carbon reduction across the whole life cycle of building materials. New York’s Local Law 97 also sets carbon emissions caps for large buildings. Other states such as Washington and Massachusetts are not far behind.

With such a vast array of measures to consider, it’s important to map what is needed, identify pressure points, and align with regulatory direction. We collaborate with our colleagues at Sagentia Regulatory to develop strategies which unlock opportunities for innovation, reduce compliance risk, and support confident decision making.

Design with certification in mind

Another critical concern for market entry is certification. Prominent green building certification frameworks like the Building Research Establishment Environmental Method (BREEAM) help address risk aversion amongst contractors and specifiers. BREEAM is UK-based but globally recognised with country-specific versions in some markets. Other certification systems include Leadership in Energy and Environmental Design (LEED) in the US.

Obtaining certification from a developer’s preferred framework is a vital step which must be considered from the outset of any innovation project. Aligning with specifications upfront can avoid practical issues related to installation, logistics, and compatibility later. Certification has a direct impact on the acceptance and use of a material.

A structured market entry plan is the secret of success. This includes early engagement with stakeholders, pilot projects to generate real-world data, and alignment with certification and procurement requirements. Planning for adoption from the outset, rather than treating it as a final step, reduces risk and improves the likelihood of successful integration.

Navigating sustainable construction trade-offs

To date, technical progress has been made across a range of material classes (see below table) but adoption at scale remains a challenge. Compatibility with legacy infrastructure, the relative immaturity of the supply chain, regulatory uncertainty, and costs all play a role.

Setting clear KPIs around durability, compliance, and environmental impact makes it easier to navigate trade-offs, track progress, and substantiate sustainability claims. Demonstrating transparency, social responsibility, and long-term value creation to investors, regulators, and customers is as important as technical performance.

In terms of cost-benefit trade-offs, targeting segments that place strategic value on sustainability, or where policy incentives change the market dynamic, may be helpful. Cost expectations can also be shaped by the competitive landscape. As more manufacturers bring low-carbon products to market, benchmarks are shifting.

If you’re innovating around sustainable construction materials and chemicals, these strategic questions can guide your thinking and decision making:

- Where can existing products be adapted to meet sustainability goals without compromising performance?

- How can circularity be embedded in ways that are technically viable and commercially scalable, including the systems and partnerships that need to support end of life recovery?

- What commercial models support adoption of higher-cost, lower-impact materials, while navigating trade-offs in cost, risk, and supply chain complexity?

- How can new materials be introduced with minimal disruption to customers and supply chains?

- How will evolving regulations affect your value chain, and how can this be used to unlock innovative and competitive opportunities?

- Which certifications frameworks will facilitate market entry?

How Sagentia Innovation can help

Sagentia Innovation helps materials developers across the construction, chemicals, and industrial sectors turn challenges into opportunities. As well as supporting technical innovation, we can assess opportunities for strategic investment or partnership, as our global assessment of technologies and providers that enable low carbon concrete demonstrates.

Identifying, testing, and commercialising sustainable solutions takes time, and early action is critical to stay ahead. If you’re exploring ways to adapt your portfolio or bring new sustainable materials to market, we can work with you to accelerate progress. Click here to make contact: Contact – Sagentia Consulting

Sustainable developments in construction materials and chemicals

| Incumbent material / chemical | Use in the built environment | Key sustainability enablers and considerations | Emerging alternatives / innovations |

| Portland cement | Core binder in concrete and mortar | Clinker substitution is the main route to lower-carbon cement, but it is dependent on the availability and performance of supplementary cementitious materials Carbon capture lowers CO2 but is costly to implement |

Geopolymers Magnesium silicate cements Carbon-cured concrete |

| Concrete admixtures | Improves workability, curing, durability, and strength | Superplasticisers are essential for most low-carbon cement mixes, supporting cement replacement strategies and marketing claims Air-entraining agents improve freeze-thaw durability for alternative binders, enabling avoided emissions Requires compatibility with cement chemistries |

Bio-based admixtures Nanomaterial dispersants |

| Steel | Structural framing and reinforcement | Scrap-based electric arc furnace (EAF) production cuts fossil fuel derived energy use Using green hydrogen in direct reduced iron (DRI) processes significantly reduces emissions |

Bamboo composites Bio-based fibre-reinforced polymers (FRPs) |

| PVC | Pipes, window frames, flooring | Bio-attributed PVC supports renewable feedstock marketing but needs robust traceability Mechanical recycling systems need consistent quality control To compete with cheap, virgin PVC, lifecycle carbon savings must be clearly demonstrated |

Bio-based polymers Thermoplastic elastomers |

| Polyurethane (PU) | Thermal insulation, sealants, coatings | Bio-based polyols reduce fossil fuel dependence while maintaining insulation performance Using low-global warming potential (GWP) blowing agents enables alignment with net-zero goals High R-value PU can be positioned as an emissions-avoiding technology for energy-efficient buildings |

Mycelium insulation Aerogels |

| Epoxy resins | Adhesives, protective coatings, industrial flooring | Bio-based and low-VOC formulations meet tightening indoor air quality regulations Reformulation requires balance between performance and sustainability claims Lifecycle emissions reductions must be substantiated for industrial customers |

Lignin-based resins Bio-epoxies |

| Silicones and acrylics | Sealants and adhesives for windows, doors, façades | Low-VOC, long-life sealants enable green building certification and reduced maintenance costs Bio-based options support sustainable sourcing claims |

Bio-based sealants Hybrid polymer systems |

| Paints and coatings | Decorative and protective finishes, corrosion/fire resistance | Low-VOC coatings are essential for indoor air quality credits Anti-corrosion and fire-retardant coatings extend life, supporting lifecycle emissions claims and emissions avoidance Evidence of durability and reduced maintenance is required |

Photocatalytic coatings Algae-based paints |

| Bitumen modifiers and membranes | Waterproofing for roofs, basements, tunnels | Recycled rubber/polymer content supports circularity Bio-based membranes reduce dependence on fossil fuels Longer service life reduces embodied carbon due to fewer repairs |

Bio-based membranes Recycled rubber systems |

Read more of our insights